The insights provided in this overview are derived from the Nationwide House Price Index report for 2023 and comments from Robert Gardner, Nationwide’s Chief Economist.

The UK housing market experienced a 1.8% decrease in house prices over the course of 2023, with only Northern Ireland and Scotland seeing price increases during the same period. East Anglia emerged as the weakest performing region, witnessing a 5.2% decline in prices.

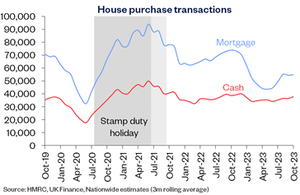

In December 2023, the average house price was £257,443, showing a slight decline from November. Robert Gardner, Nationwide’s Chief Economist, noted that housing market activity remained weak throughout the year, with total transactions running below pre-pandemic levels, especially those involving mortgages.

Despite modestly lower house prices and rising incomes, the impact of higher mortgage rates contributed to stretched housing affordability. The article highlights that a borrower earning the average UK income, purchasing a typical first-time buyer property, would face a monthly mortgage payment equivalent to 38% of take-home pay.

Looking ahead to 2024, Gardner suggests that a rapid rebound in activity or house prices is unlikely. While there are optimistic signs with decreasing mortgage rates, consumer confidence remains weak, and surveyors report subdued new buyer enquiries. The expectation is for housing market activity to remain subdued, with a possibility of another small decline or relatively flat prices (perhaps 0 to -2%) over the course of 2024.

The regional house price indices for Q4 2023 show declines in most areas, with Northern Ireland being the best performer, experiencing a 4.5% increase, and East Anglia being the weakest, with a 5.2% year-on-year decline.

Notably, the property type review reveals a shift in buyer preferences towards smaller, less expensive properties, with transaction volumes for flats holding up better than other types. However, in the most recent data, there is a convergence in the annual rate of price growth for different property types, with semi-detached properties holding up the best, recording a 1.8% year-on-year fall.

In concussion, the UK housing market in 2023 faced challenges with weak activity, stretched affordability, and regional variations in price performance. The outlook for 2024 suggests a gradual improvement in affordability, but a significant rebound in activity or prices is not expected. Please note that this information is based on the Nationwide House Price Index report and comments from Robert Gardner, Nationwide’s Chief Economist.

🚨 Data accurate as of the date of publication – 08.01.2023

🚨Think carefully before securing debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

🚨 The above material is for informational purposes only and does not constitute a sales offer or financial advice. Before taking out any insurance, credit agreement or other financial product, you should obtain individual advice on your requirements and the general terms of the contract.

Source: Nationwide – House prices fall 1.8% over the course of 2023 (nationwidehousepriceindex.co.uk)