Our monthly property market review is intended to provide background to recent developments in property markets as well as to give an indication of how some key issues could impact in the future.

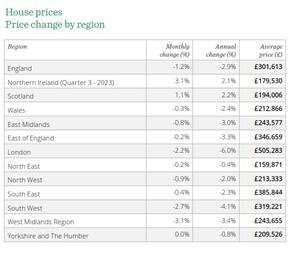

- Average house prices in the UK decreased by 2.1% in the year to November 2023.

- On a non-seasonally adjusted basis, average UK house prices decreased by 0.8% between October 2023 and November 2023.

- The average price in London was £505,283.[1]

“As we move through 2024, the UK property market will continue to reflect the wider economic uncertainty, and buyers and sellers are likely to be naturally cautious when considering making a move. While wage growth is now above inflation, helping to ease cost-of-living pressures for some and improving housing affordability, interest rates are likely to remain elevated for as long as inflation remains markedly above the Bank of England’s target.

Our latest forecast suggests house prices could fall between -2% and -4% during the coming year, although, as with recent years, forecast uncertainty remains high given the current economic climate.” [2]

[1] The Land Registry, 17.01.2024

[2] Kim Kinnaird, Director, Halifax Mortgages, December 2023

🚨 Data accurate as of the date of publication –31.01.2023

🚨Think carefully before securing debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

🚨 The above material is for informational purposes only and does not constitute a sales offer or financial advice. Before taking out any insurance, credit agreement or other financial product, you should obtain individual advice on your requirements and the general terms of the contract.

Source: Quilter Financial Planning – Residential Property Review, January 2024